The State of the Pharma Cold Chain

While vendors fill in gaps in products and services for the supply chain, the action moves toward new cloud-based visibility systems.

Over the past decade, the industry practices associated with delivering temperature-sensitive pharmaceuticals have undergone a rapid evolution. In the 2000s, a pharmaceutical cold chain interest group arose, almost spontaneously, among industry experts to raise up and standardize industry best practices. Vendors—including many newly formed companies developed new methods of protecting shipments with high-tech containers, new procedures for maintaining required temperatures, and new methods for tracking and recording shipping conditions. In parallel, organizations including US Pharmacopeia, the International Safe Transport Association, the Parental Drug Association, and the International Air Transport Association (among quite a few others), formalized guidances and protocols, or updated existing practices. Behind these stand the FDA and the European Medicines Agency (EMA), charged with ensuring the safety and efficacy of the drugs the industry has been delivering.

All this was put severely to the test during the COVID-19 pandemic, and for the most part, the industry came through with flying colors, even though the leading vaccine offerings required a temperature regime (-80°C) that had only occasionally been seen previously. The various service providers for pharma cold chain distribution expanded their capacity and upgraded their service levels on a near-emergency basis—and those improvements are benefiting the pharma industry today.

“The pandemic created a broader perspective compared to how cold chain distribution evolved over the past 10 or 20 years,” says Henry Ames, director, global life sciences and healthcare at Everstream Analytics, a supply chain analytics and risk firm. Traditionally, risk analysis for the cold chain involved validating packaging and trade lanes; now, it involves visibility to upstream suppliers, geography, and weather, among others. “There’s more evidence of this focus in proposed legislation in the US Congress to address resilience and visibility in the pharma supply chain," he adds.

New hardware at the margins

Significantly, new technologies had been introduced to the pharma cold chain over the past several years, such as refrigerated ocean containers, dataloggers connected to cellular networks, or high-performance, reusable packaging for ultracold shipments. Now, there continues to be a flow of new and improved products, but more on a level of filling in gaps in existing cold chain practices. For example, CSafe, maker of both active and passive containers, is introducing a pallet-size air freight container rated at -20°C, complementing its existing fleet of 2-8°C RKN containers. Also:

• Sonoco ThermoSafe introduced its Pegasus unit-load device (ULD) a few years ago; in the past year, around a dozen air carriers, as well as logistics providers, have certified its use in global air freight. The ULD is notable for being a passive (non-powered) unit, rated for 300 hours in 2-8°C service, yet FAA- and EASA-approved as a component of flight equipment.

• Cryoport, which specializes in ultracold biologics shipping, usually with liquid nitrogen at -170°C, is introducing its Elite branded ultracold container rated for -80°C and employing dry ice. Another design, the CryoSphere, an LN2 dewar for deep-frozen shipping, is scheduled for release early next year. That unit will have the innovation of operating equally in any physical

orientation (most dewars require upright positioning, a common problem during shipping).

• Envirotainer, a provider of air-freight ULDs (and usually for 2-8°C service), is jumping into the ultracold space with CryoSure, a one-to-11-liter box for -70°C service, targeting the new mRNA-based vaccines and therapeutics.

• Another ULD provider, Swiss Airtainer, is introducing an active ULD for pallet shipments that is 40% lighter than competing versions; the unit is said to offer cost efficiencies for shippers due to its low weight.

Low-temperature shipping is the driver for several of these examples, pointing to the dramatic advances in cell and gene therapies (CGTs) over the past several years. A potential new direction is indicated by the German refrigeration company Secop GmbH, which last year introduced a two-stage compressor driven refrigeration unit that can achieve temperatures as low as -86°C; however, its use in shipping containers is still to be determined.

“With well-established active or passive containers and packages, as well as the growing practice of pre-qualified packages (not requiring validation testing prior to use), the packaging and datalogging/monitoring element of pharma cold chain shipping is definitely becoming commoditized,” says Everstream’s Ames. “The barriers to entry for packaging and data collection have dropped, making it easier to shift from one solution to the next” he adds, “but validation to meet the most rigorous industry standards is still a challenge.”

Business plateau?

Another hallmark of the past decade of cold chain development has been its rapid growth relative to the pharma industry overall. Past surveys showed that pharma cold chain shipments were growing at twice the rate of industry overall, usually in the low double-digit range. There are indications that that rate has slowed somewhat: a key factor is the rate of new FDA drug approvals, which dropped from 55 in 2021 to 45 in 2022. Several CGTs that were expected to already be introduced commercially this year have been postponed or delayed as well.

On the other hand, 2023 is a milestone year for biosimilars, at least in the US market, where Humira (adalimumab), AbbVie’s $20+-billion blockbuster, is seeing biosimilar competition in the US market. According to a January report from IQVIA, roughly 24% of the US market for biologics was accessible to biosimilars at the end of 2022—a figure that is only going to go up.

Normally, the lower prices inherent in biosimilars would lead to an expanded volume of prescriptions; however: “As biosimilars become available, most molecules have seen incremental volume ranging from +7% to +154%, but there are notable cases where incremental volume has been flat or declining, ranging from -1% to -30%,” the report notes.

Other factors come into play when considering the pharma cold chain market. The overall logistics market in the US is softer, coming out of the pandemic, but “in healthcare and pharmaceuticals, home delivery is having a big jump, and will be growing exponentially in the coming years,” says Dan Gagnon, a SVP for marketing for UPS Healthcare Logistics.

“More bulk commercial shipments will be going to small packages shipped directly to the home,” he says. That will make for more deliveries per annum.

There is a mixed bag of indicators when looking at business trends in the cold chain. On the one hand, the past year has seen some significant consolidations: Envirotainer has acquired one of its key competitors, the healthcare business of va-Q-tec (which will expand Envirotainer’s offerings of passive shipping solutions).

Last fall, UPS Healthcare Logistics acquired Bomi Logistics, a global healthcare logistics provider based in Italy. The acquisition added four million square feet of warehousing capacity to UPS’ (which now totals 15.5 million square feet), and enlarges UPS Healthcare Logistics’ footprint in Europe and South America. In the life-sciences datalogging market, SpotSee has acquired Marathon Products, another datalogging company.

On the flip side of these consolidations, the pharma cold chain continues to attract private-equity capital. Witness two deals announced this year: NewSpring Healthcare (along with existing investors) putting $43 million into AeroSafe Global, a container and logistics service provider, in June; and Lazard Asset Management taking a minority share in SkyCell AG, for an undisclosed amount, in March. The biggest deal of all, announced in mid-2022, was Envirotainer’s sale from one set of investors to another, EQT and Mubadala, for an approximately $3 billion.

Summing up, a July report from Visiongain, a UK market research company, valued the current healthcare cold chain logistics market at $17.8 billion this year, projected to grow at a 9.0% compound annual growth rate (CAGR) through 2033.

The visibility buzz

The part of the pharma cold chain generating the most buzz today is in visibility: the ability to track a shipment, along with its environmental conditions, from point of origin to point of destination, in real or near-real time. The traditional practice was to include a datalogger that could record the internal temperature of the shipment. That datalogger would be accessed at the destination to confirm safe, compliant delivery. Now, between advances in telemetry, including a variety of Wi-Fi and wireless networks, and advances in software—most notably incorporating new capabilities in artificial intelligence/machine learning (AI/ML)—a new level of supply chain management and optimization is becoming clear.

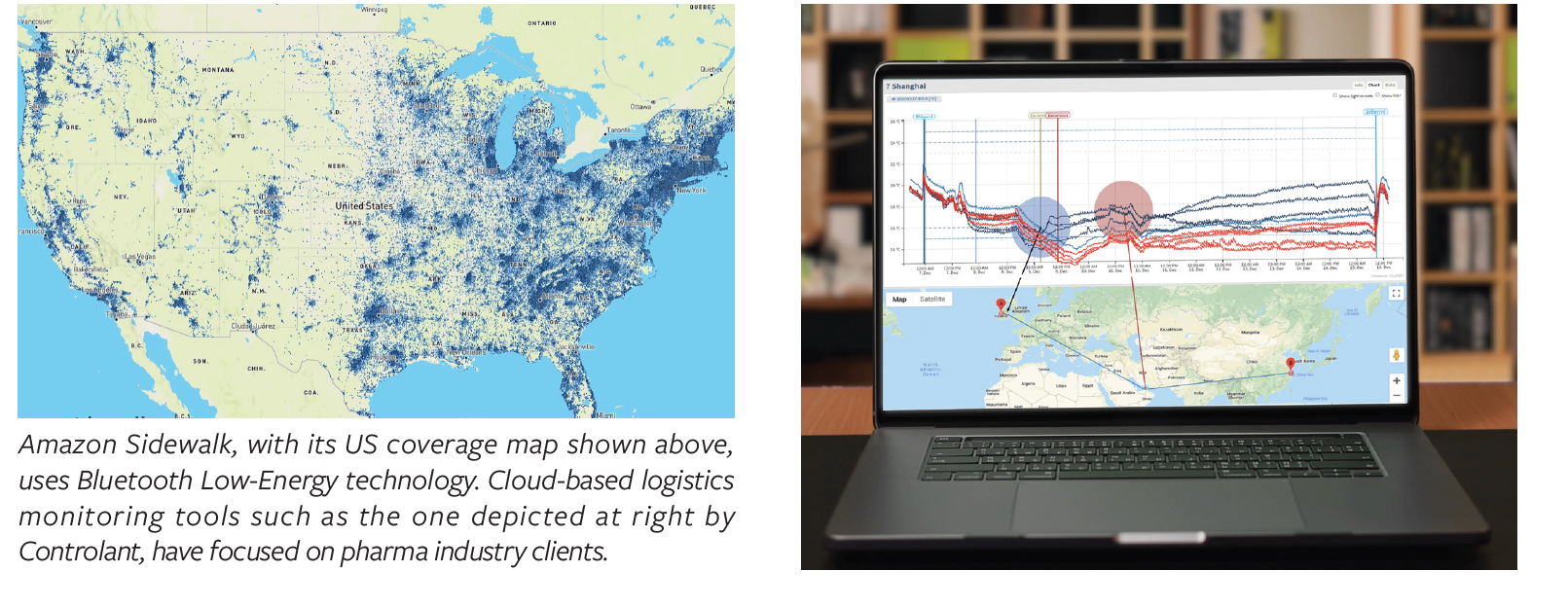

Real-time tracking is not new; various vendors have used cellular communications to enable it for quite a while. What is new is the internet of things (IoT) influence: with the expanding availability of communications devices that can collect signals automatically, the data-gathering becomes a lower-cost, less effortful exercise. Making use of a cloud data-services provider is also key. One of the more promising examples of this is Amazon Sidewalk (with Amazon Web Services cloud behind it), which is building up its network of consumer-focused data collectors and communicators (such as its Ring doorbell). Amazon Sidewalk employs Bluetooth Low-Energy technology, which is short-range, but if enough devices are located

adjacently, it can provide network coverage over a wide geography. Last spring, Amazon released a map (see graphic above) that, according to it, represents coverage for 90% of the US population.

The barriers to entry for packaging and data collection have dropped, making it easier to shift from one solution to the next.

In turn, OnAsset Intelligence, a company that has provided sensors and dataloggers for use in pharma logistics for years, has announced its Sentinel 200 device, a datalogger/communicator used by, among others, the clinical logistics firm Marken, is now compatible with Sidewalk. (On Asset already makes use of Bluetooth communications and Wi-Fi.)

Quite a few companies that specialize in cloud-based logistics communications have focused on the pharma industry as a key client. These include ParkourSC; Roambee; Controlant; FourKites; SendCloud; and others. Some of these companies provide both sensors and a cloud-based data-management system; some are software-only. Some have garnered FDA CFR Part 11 compliance and related life- sciences data validation; some have not. Most are aligned with third-party logistics providers (3PLs) and freight forwarders; some are even embedded in cold-chain containers. Among the software-only providers, the race is on to build the best AI/ML capability, thereby bringing preventive management

or supply chain optimization to the table.

All this activity is gradually being taken up by the pharma industry.

“After 35 years, AI is suddenly an overnight success,” wryly comments Jerry Shelton, CEO of Cryoport. While open to working with the sensor and software providers, his company is building out a condition monitoring service called SkyTrax.

“One example of the difficulties in this area is wireless communications," adds Shelton. "While much of the industrialized world is adapting to 5G cellular communications, Japan still operates in 2G or 3G. Our technology enables an automatic switch from one cellular band to another. That creates a seamless chain of custody.”

“I am super excited about what our company is doing, and what the supply chain software developers are doing,” says UPS’ Gagnon. “But I think the whole logistics industry is trying to figure out what can be solved with this technology and what makes an impact.” The IoT trend seems to be “a great

solution looking for a big problem” to solve, continues Gagnon.

A better planet

After years of paying lip service to the concept, the pharma industry is getting serious about sustainable practices, say industry observers. In practice, this usually means looking at the carbon footprint of logistics, and paying attention to materials use and wastage in packaging and related cold chain hardware.

While there is some backlash publicly over environmental, social, and governance (ESG) ratings, especially in the US, pharma supply chain managers are fairly uniform in including environmental criteria in their request for proposals (RFPs), and acting on what is reported.

“Large corporations have 2025 or 2030 goals for reducing their carbon footprint,” notes Amardeep Chahal, SVP of marketing at Cold Chain Technologies, a packaging provider. Cold Chain Tech approaches this task two ways: with a reuse program that, where possible, enables a circular loop of loaded packages going to a destination, and empty packages being picked up, refurbished, and returned to use. The company also touts its CCT Rx and CCT TrueTemp Naturals containers, which are “curbside recyclable” packages made primarily of paper. The company is well along on its goal of avoiding 60 million pounds of packaging from the waste supply stream.

Most of the packaging companies have some level of reuse or container leasing going on; they vary on how broadly their networks are located. Vendors of high-performance packaging featuring vacuum panels and sturdier boxes point out that a solid reuse program helps offset the higher

unit cost (but better performance) of their offerings, thus providing a potentially more reliable shipping solution) to the industry. Chahal says that across the industry, he estimates that 15% of packages are now being reused (excluding most air-freight ULDs, which are reusable of

necessity), and the volume is growing.

— Nicholas Basta is Editor Emeritus and Founder of Pharmaceutical Commerce.

Is Compounding the Answer to the Semaglutide Shortage? Experts Weigh In

October 30th 2024In this Q&A, Scott Brunner, CEO, and Tenille Davis, Chief Advocacy Officer, of the Alliance for Pharmacy Compounding discuss the challenges faced by patients and healthcare providers due to drug shortages, particularly for semaglutide and other medications.